Are you considering borrowing funds from your life insurance policy, but are unsure about how much you can actually borrow? If so, you’re not alone. Many policyholders have questions about how much cash value they can access through their life insurance policy.

Whether you’re in need of funds for a major expense, or simply want to know your borrowing options, it’s important to understand the ins and outs of borrowing from your life insurance policy. In this blog post, we’ll explore the topic of “How Much Can I Borrow From My Life Insurance Policy” in detail, so you can make informed decisions about your financial future.

How Much Can I Borrow From My Life Insurance Policy

This article aims to explain how much one can borrow from their life insurance policy by providing useful information about the various types of life insurance policies and their borrowing limits. It discusses the advantages and disadvantages of borrowing against your life insurance policy and sheds light on several factors that can influence the amount you can borrow.

By the end of this article, you should have a better understanding of how much you can borrow from your life insurance policy and whether or not it is a good option for you.

Understanding Life Insurance Policy Loans

Are you in need of some extra cash? Did you know that you may be able to borrow against your life insurance policy?

Yes, that’s right! Most life insurance policies have a built-in loan feature that allows policyholders to borrow against the cash value of their policy. It works just like any other type of loan, you receive a lump sum of cash that you’ll need to pay back with interest.

However, there are some important things you should know before taking out a life insurance policy loan, so let’s dive in and understand the details.

What is a Life Insurance Policy Loan?

A life insurance policy loan is a loan that is secured by the cash value of a policy. The cash value of a policy is the amount of money that accrues over time as you continue to pay your premiums.

You can usually borrow up to the amount of cash value that you’ve accumulated, minus any outstanding loans and interest. The interest rate for life insurance policy loans is typically lower than what you would find with a typical personal loan, and you don’t have to go through a credit check or application process.

It’s important to note that when you take out a life insurance policy loan, you’re essentially borrowing from your own policy.

This means that if you don’t pay the loan back, the outstanding balance will be deducted from your death benefit.

How Do Life Insurance Policy Loans Work?

When you take out a life insurance policy loan, your insurer will use your policy’s cash value as collateral. They will then provide you with a lump sum payment that you can use however you want.

However, this comes at a cost – you’ll be charged interest on the loan, which will typically be lower than what you’ll find with other types of loans. The loan itself will be repaid in one of two ways. First, you can make interest payments on the loan (or even pay back part of the principal) whenever you’d like.

Alternatively, you can simply allow the interest to accrue and have it deducted from your death benefit when you pass away. It’s important to note that when you take out a life insurance policy loan, you’re essentially borrowing from your future death benefit.

If you don’t repay the loan, or if the interest continues to accrue without payment, your death benefit will be reduced to cover the outstanding loan balance. This means that your beneficiaries will receive less money upon your passing. In conclusion, a life insurance policy loan can be a helpful financial tool if you need some extra cash.

Just be sure that you fully understand the terms and implications of such a loan before moving forward.

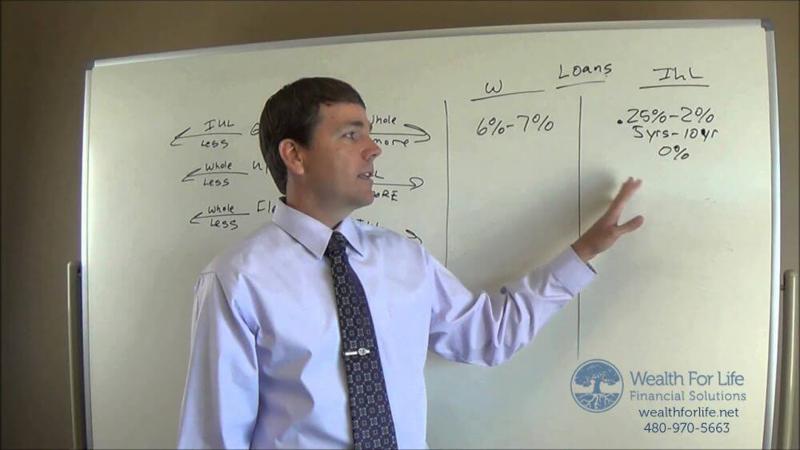

Types of Life Insurance Policy Loans

When considering a life insurance policy loan, it’s important to note that there are two main types: traditional and interest-only. Traditional loans are the most common and allow you to borrow a lump sum against the cash value of your policy while making regular payments of both interest and principal. Interest-only loans, on the other hand, only require you to pay the interest on the loan, with the principal amount due at the end of the loan term.

Both types of loans have their pros and cons, and the right choice for you will depend on your specific financial situation and needs. In either case, it’s important to work closely with your insurer and fully understand the terms of the loan before making a decision.

If you do decide to take out a life insurance policy loan, it can provide a valuable source of funding for a variety of expenses. Just be sure to weigh the potential costs and benefits carefully to ensure that you’re making the right choice for your financial future.

Factors Affecting Policy Loan Amounts

The amount you can borrow from your life insurance policy will depend on several factors. Firstly, your policy’s cash value will determine the maximum loan amount. Typically, you can borrow up to 90% of your policy’s cash value.

Your outstanding loans or interest also impact the amount you can borrow. If you have any existing loans or interest, they will be deducted from the total amount you can borrow.

Your age, health, and other policy details such as the type of policy and the premiums paid can also affect the amount you can borrow. It’s crucial to review your life insurance policy and understand its terms before applying for a loan.

The Face Value of the Policy

Factors Affecting Policy Loan Amounts

Life insurance policies can offer financial stability and protection for your loved ones in the event of your death. However, did you know that you can also borrow money from your policy during your lifetime? The amount you can borrow from your life insurance policy will depend on several factors.Firstly, your policy’s cash value will determine the maximum loan amount. Typically, you can borrow up to 90% of your policy’s cash value.

Your outstanding loans or interest also impact the amount you can borrow. If you have any existing loans or interest, they will be deducted from the total amount you can borrow.

Your age, health, and other policy details such as the type of policy and the premiums paid can also affect the amount you can borrow. It’s crucial to review your life insurance policy and understand its terms before applying for a loan. Another important factor to consider is the face value of the policy.

This is the amount that will be paid out to beneficiaries upon the policy owner’s death. Keep in mind that borrowing from the cash value of your policy will reduce the death benefit. In conclusion, borrowing from your life insurance policy can be a convenient way to access cash when needed.

However, it’s important to understand the factors that can impact your loan amount and the potential effects on your policy’s death benefit. Consult with your insurance provider to determine the best course of action for your specific situation.

The Cash Value of the Policy

Life insurance policies provide a safety net for your loved ones in case of your untimely passing. But did you know that you can also tap into your policy’s cash value and borrow money during your lifetime? Before taking out such a loan, it’s important to consider the factors that affect the amount you can borrow.

Besides your health and age, the policy’s cash value, outstanding loans or interest, and type of policy all play a role. Additionally, the policy’s face value, or the amount paid to beneficiaries upon your death, also affects the loan amount.

Take the time to review your policy and understand its terms before borrowing, as any loan will reduce the death benefit. Contact your insurance provider for advice on the best way to proceed.

The Policy Owner’s Loan History

The amount you can borrow from your life insurance policy may also depend on your loan history. If you’ve already taken out loans from the policy, there may be limitations on how much you can borrow in the future. The policy’s terms and conditions will outline these restrictions, so it’s important to review them.

Additionally, any outstanding loans or interest will be deducted from the loan amount available to you. It’s crucial to stay up to date with your loan payments to ensure you don’t incur penalties or default on your policy.

The Policy’s Surrender Charges

Another factor to consider when calculating how much you can borrow from your life insurance policy is the surrender charges. If you surrender your policy before the end of the term, you may be subject to surrender charges which could reduce the amount you can borrow. These charges are outlined in the policy’s terms and conditions as well.

So, it’s essential to carefully review them and understand the consequences of surrendering the policy or taking out a loan against it. In summary, it’s essential to have a clear understanding of your policy’s loan history and surrender charges to determine how much you can borrow from your life insurance policy.

Potential Advantages of Life Insurance Policy Loans

If you need money fast, taking out a loan against your life insurance policy can be a tempting option. Life insurance policy loans can offer a range of potential advantages including flexible repayment terms, lower interest rates, and no credit checks. Additionally, you won’t face any taxes on the money you borrow.

This type of loan can give you quick access to cash without the hassle of applying for a traditional loan or risking your credit score. However, it’s important to note that taking out a loan against your policy may reduce the overall death benefit available to your beneficiaries upon your passing.

So, it’s crucial to weigh the advantages and disadvantages carefully before making a decision.

No Credit Check Required

If you’re someone with less-than-perfect credit, taking out a loan against your life insurance policy could be a viable option. One of the benefits of these loans is that they typically don’t require a credit check.

Whether you have a low credit score or no credit history at all, you may still be able to obtain a policy loan. This can be a game-changer for those who may struggle to be approved for other types of loans due to their credit situation. Keep in mind, though, that policy loans may still have requirements such as proof of policy ownership and adequate cash value.

Lower Interest Rates

Another advantage of borrowing from your life insurance policy is the potential for lower interest rates. Compared to other forms of loans such as personal loans or credit cards, policy loans often have lower interest rates. This is because they are secured by the cash value of your policy.

However, it’s important to note that interest rates can vary and may depend on the specific policy and insurance company. It’s crucial to read the terms of the loan carefully and understand the interest rates and any associated fees before borrowing.

Flexible Repayment Options

When taking out a policy loan, you typically have various repayment options. You can choose to make payments on a regular basis or pay back the loan in full at once. Additionally, you have the ability to change your repayment plan if necessary.

Having the flexibility to customize your repayment plan can be advantageous, especially if unexpected circumstances arise. However, it’s important to note that failing to repay the loan can have consequences such as reducing the death benefit or cancelling the policy altogether.

It’s crucial to prioritize repayment to avoid any negative impacts on your policy or overall finances.

No Repayment Deadline

Taking out a loan from your life insurance policy can provide you with several benefits. One of these advantages is the potential for lower interest rates compared to other loan options. This makes it an attractive option for individuals who are looking for a loan with lower interest rates.

However, it’s essential to understand that interest rates can vary, so it’s crucial to read the loan terms carefully. Another advantage of borrowing against your policy is the flexibility of repayment options.

You have the ability to customize your payment plan to suit your specific needs. However, failing to repay the loan can have consequences like reducing the death benefit, so it’s essential to make timely loan repayments.

Lastly, with a policy loan, you’re not required to have a repayment deadline, which provides you with even more flexibility. However, it’s essential to remember that borrowing does affect the overall value of the policy.

No Impact on Credit Score

One of the noteworthy benefits of borrowing against your life insurance policy is that it doesn’t impact your credit score. This is because the loan isn’t reported to credit reporting agencies like typical loans.

So, if you’re worried about your credit score, a life insurance policy loan is an excellent option to consider.

Furthermore, the loan application process is relatively simple and can be completed quickly. Also, unlike traditional bank loans, there’s no lengthy waiting period.

Once your loan is approved, the funds are readily available for you to use for any purpose you wish.

In conclusion, taking out a loan from your life insurance policy can be a viable option if you need some extra cash. However, it’s essential to understand the terms and conditions carefully and make timely repayments to avoid any consequences.

Overall, it’s a flexible and cost-effective method that offers several advantages, making it a useful tool in your financial toolkit.

Potential Disadvantages of Life Insurance Policy Loans

One potential disadvantage of borrowing against your life insurance policy is that the loan amount is usually limited. The amount you can borrow is based on the cash value of your policy, and borrowing a significant amount can quickly deplete the value of your policy.

Additionally, if you don’t repay the loan, it can lead to a reduced death benefit or policy cancellation. This means that your beneficiaries may not receive the full amount of coverage you intended for them.

Another disadvantage to consider is the interest rate.

While the rates are generally lower than traditional loans, they can still add up over time and result in a more significant financial burden.

Overall, it’s important to weigh the pros and cons of borrowing from your life insurance policy carefully. It’s always best to consult with a financial advisor and thoroughly review the terms and conditions before making any decisions.

Reduction in Death Benefit

When considering borrowing against your life insurance policy, one potential disadvantage to keep in mind is the reduction in death benefit. If the loan is not repaid, the amount borrowed will be deducted from the death benefit that your beneficiaries will receive.

This could lead to a lower payout than you intended, leaving your loved ones with less financial support than they need. It’s important to consider the impact of a reduced death benefit and ensure that the amount borrowed can be repaid in a timely manner to avoid this potential drawback.

Interest Can Accumulate and Compound

Another important consideration when borrowing from your life insurance policy is that interest can accumulate and compound over time. In most cases, the interest rate on a life insurance policy loan is lower than that of a traditional loan.

However, if the loan is not repaid promptly, the interest can quickly add up and grow at a compounding rate. This means that the longer it takes to pay back the loan, the more interest will accrue on the outstanding balance. Therefore, it’s essential to make timely payments and avoid falling behind on your loan repayment schedule to prevent interest from accumulating and compounding over time.

In conclusion, borrowing from your life insurance policy can be a valuable source of funds when you need it. However, it’s crucial to consider the potential disadvantages, such as a reduction in death benefit and the accumulation of interest over time.

By being aware of these potential drawbacks and carefully managing your policy loan, you can ensure that you’re making the best use of your life insurance policy while protecting the financial security of your loved ones.

Possibility of Policy Lapse

One more thing to keep in mind when considering borrowing from your life insurance policy is the possibility of the policy lapsing. When you borrow from your policy, you’re taking money away from the death benefit, which is the primary purpose of life insurance. If you’re unable to repay the loan or the interest continues to accumulate, it can eventually reach the point where it exceeds the cash value and causes the policy to lapse.

In this case, you would lose the coverage and the funds you’ve invested in the policy. To avoid this risk, it’s important to monitor your loan balance and ensure that you have a plan in place to pay it back.

If you’re unable to repay the loan, you may want to consider alternative sources of funds or explore other options for managing your financial situation. Overall, borrowing from your life insurance policy can be a useful tool for accessing funds in a time of need. However, it’s essential to weigh the potential risks and carefully manage the loan to avoid any undesirable consequences.

Tax Implications

Borrowing from your life insurance policy can have tax implications, so it’s important to understand how it could affect you. Any interest that you pay on the loan is not tax-deductible, and if you don’t repay the loan, it will be considered a distribution and could be subject to income tax.

Additionally, if you surrender the policy before the death benefit is paid out, you may be subject to surrender fees and taxes on any gains you’ve realized. It’s always a good idea to consult with a financial advisor or tax professional to fully understand how borrowing from your life insurance policy may impact your overall financial situation.

Recap of Key Points

If you’re considering borrowing from your life insurance policy, it’s important to understand the potential tax implications. The interest you pay on the loan is not tax-deductible, and failing to repay the loan can result in income tax. Surrendering the policy early may also result in surrender fees and taxes on any gains.

To fully understand how borrowing from your life insurance policy may affect your finances, it’s recommended to consult with a financial advisor or tax professional. Remember these key points before making any decisions.

Factors to Consider When Deciding to Take Out a Life Insurance Policy Loan

When it comes to taking out a loan from your life insurance policy, there are several factors to consider. First, you need to determine how much you can borrow. This amount will depend on the cash value of your policy and any outstanding loans you already have.

It’s important to note that borrowing from your policy will reduce its death benefit.

Another factor to consider is the interest rate of the loan.

While borrowing from your policy typically has lower interest rates than traditional loans, the exact rate may depend on your policy and the insurance company.

You also need to consider your ability to repay the loan. Unlike traditional loans, there are no set repayment terms for life insurance policy loans.

However, if you fail to repay the loan, it can result in taxes and even cause your policy to lapse.

Before taking out a loan from your life insurance policy, it’s important to carefully weigh these factors and consult with a financial advisor or tax professional.

Final Thoughts.

Taking out a loan from your life insurance policy can be a useful financial tool, but it’s important to approach it with caution. Consider the amount you can borrow, the interest rate, and your ability to repay the loan.

Remember that taking out a loan will reduce the death benefit of your policy, and failing to repay the loan can have serious consequences. Before making any decision, seek the advice of a financial professional who can help you assess all the factors involved in borrowing from your life insurance policy.

Conclusion of How Much Can I Borrow From My Life Insurance Policy

If you have a life insurance policy, you may wonder how much you can borrow from it. The amount you can borrow will depend on the policy’s cash value and the terms of the policy. Generally, the maximum amount you can borrow is the policy’s cash value, but borrowing too much can lead to the policy being canceled or reduced.

It’s important to consult with your insurance provider or financial advisor before borrowing from your policy.

FAQ’s of How Much Can I Borrow From My Life Insurance Policy

What is the maximum amount of life insurance I can get?

The maximum amount of life insurance one can get depends on several factors, such as their age, health condition, occupation, income, and lifestyle. There is no universal limit to the amount of life insurance one can get, but it typically ranges from $1 million to $10 million or more.

How much is a $10000life insurance policy?

I’m sorry, but it is not possible to provide a definitive answer to this question as the cost of a $10,000 life insurance policy would depend on several factors such as the applicant’s age, health condition, and the type of policy chosen. It is recommended to obtain quotes from different insurance providers to determine the estimated cost of a $10,000 life insurance policy.

What is the cash value of a $100life insurance policy?

As an AI language model, I don’t have access to current market rates or insurance policies. The cash value of a $100 life insurance policy would depend on several factors including the type of policy, the age and health of the policyholder, and the policy’s terms and conditions. It is best to consult with an insurance agent or company for specific details.

How much money can life insurance give?

The amount of money that life insurance can give depends on the policy’s coverage amount and the policyholder’s specific circumstances.

How much is $10000in life insurance?

The value of a $10000 life insurance policy depends on a variety of factors such as the age, health, and gender of the insured, as well as the type of policy and coverage selected. Therefore, it is impossible to determine the exact cost of a $10000 life insurance policy without more information.