Life insurance is an essential financial planning tool that gives protection to individuals and their loved ones in case of unexpected events. While there are various types of life insurance policies available in the market, life insurance whole life policy is one of the most popular ones. This is because it provides both protection and savings over a lifetime.

This type of policy offers a fixed premium and a guaranteed cash value component that increases over time. Whole life insurance policies provide security to the policyholder’s family in case of their untimely demise while also offering a long-term financial planning solution.

In this blog, we will discuss the benefits and features of a life insurance whole life policy.

Life Insurance Whole Life Policy

In this article, we will be exploring the concept of whole life insurance policies. We will explain what a whole life policy is, how it differs from other types of life insurance policies, and the benefits and drawbacks of purchasing one. We will also discuss the various types of whole life policies available, along with factors to consider before choosing a policy that is most suitable for an individual’s needs.

What is a Whole Life Insurance Policy?

Whole life insurance, also known as permanent life insurance, is a type of life insurance that provides lifetime coverage for the policyholder. A whole life insurance policy builds cash value over time, which means that a portion of the premium paid is invested and earns interest. This cash value can be used by the policyholder in various ways, such as borrowing against it or surrendering the policy for its cash value.

Whole life insurance policies provide peace of mind to the policyholder by ensuring that their loved ones will receive a death benefit no matter when they pass away. It is a popular choice for those who want lifelong protection and the benefits of a cash value component that can be used for different goals.

Definition of Whole Life Policy

A whole life policy is a type of permanent life insurance that offers lifetime coverage and a cash value component. It is designed to provide policyholders with financial protection throughout their entire lifetime, as long as premiums are paid. The cash value component of a whole life policy can be used by the policyholder for various purposes, such as borrowing against it or surrendering the policy for its cash value.

The premiums for a whole life policy are generally higher than those for term life insurance, but the peace of mind it provides can be invaluable.

Features of a Whole Life Policy

There are several features that make a whole life policy unique. One key feature is that the premiums paid into the policy build up the cash value component over time.

This cash value grows tax-deferred and can be accessed by the policyholder during their lifetime.

Additionally, the death benefit of a whole life policy is guaranteed and will remain the same throughout the policyholder’s lifetime, as long as premiums are paid.

Another feature of a whole life policy is that it can be used as collateral for loans or other financial transactions, providing policyholders with additional financial flexibility.

Benefits of a Whole Life Policy

The primary benefit of a whole life policy is the lifetime coverage it provides. This means that policyholders can have peace of mind knowing that their loved ones will receive a guaranteed benefit upon their death, regardless of when that occurs.

Additionally, the cash value component of a whole life policy can be a valuable asset for policyholders during their lifetime. It can be used for a variety of purposes, such as covering unexpected expenses, supplementing retirement income, or leaving a legacy for loved ones.

Overall, a whole life policy is a valuable financial tool for those looking for long-term protection and financial flexibility.

Benefits of a Whole Life Policy

A whole life insurance policy can be a smart investment for those seeking lifetime coverage and financial stability. The policy’s unique features, such as the cash value component that grows tax-deferred over time, provide policyholders with additional financial options. Plus, the ability to use the policy as collateral for loans or other financial transactions adds to its flexibility.

But perhaps the greatest benefit of a whole life policy is the peace of mind it provides, knowing that loved ones will receive a guaranteed death benefit regardless of when death occurs. Overall, a whole life policy is a reliable and valuable financial tool for those looking for long-term financial security.

How Does a Whole Life Policy Work?

A whole life policy offers coverage for the entirety of the policyholder’s life, as long as premiums are paid on time. The policy also includes a savings component, the cash value, which grows over time and earns interest.

This cash value can be accessed by the policyholder through loans or withdrawals, providing financial flexibility. Premiums for a whole life policy are typically higher than for other types of life insurance, but the added benefits and long-term coverage make the investment worthwhile. Additionally, the death benefit is guaranteed and can be used by beneficiaries in any way they choose, providing peace of mind and financial stability.

Overall, a whole life policy offers a combination of long-term protection and financial benefits that make it an attractive choice for those seeking reliable life insurance coverage.

Premiums and Payments

When a policyholder purchases a whole life insurance policy, they pay a set amount in premiums, typically for the duration of their life. The premiums are based on a number of factors, including the policyholder’s age, health, and gender. The cash value component of the policy grows over time, providing savings and potential investments, while the death benefit remains constant.

Some whole life policies may offer the option to pay premiums for a limited amount of time, such as 10 or 20 years, but this results in higher premiums during that time frame. It is important to carefully consider the premium and payment options when selecting a whole life policy to ensure that it fits into your long-term financial plan.

Cash Value Accumulation

One of the key benefits of a whole life insurance policy is the accumulation of cash value over time. This cash value is essentially a savings account that grows tax-deferred over the life of the policy. As the policyholder makes premium payments, a portion is allocated towards the cash value component, which can be accessed through policy loans or surrendering the policy.

The cash value can also be used as collateral for loans or to pay premiums. Additionally, some policies may offer the opportunity to invest the cash value in a variety of investment vehicles, such as stocks or bonds, potentially leading to even greater growth.

It is important to note, however, that any loans or withdrawals from the cash value may impact the death benefit of the policy.

Death Benefit

Whole life insurance policies offer a guaranteed death benefit, which is paid out to the policy’s beneficiaries upon the death of the insured. This provides peace of mind for policyholders, who can rest assured that their loved ones will be taken care of financially in the event of their passing. The death benefit is typically tax-free, and the amount is determined at the time of purchase.

Some policies offer the option to increase the death benefit over time, which can be especially beneficial as the cost of living and financial needs of the policyholder’s beneficiaries may increase. It’s important to review and update the death benefit as needed, as changes in personal circumstances or financial goals may require adjustments to the policy.

Additionally, the death benefit amount can be affected by any loans or withdrawals made from the cash value component of the policy. Overall, a whole life insurance policy offers both financial protection and the potential for long-term savings and investment growth. It’s a valuable tool for those looking to secure their family’s financial future and build wealth over time.

Who Should Consider a Whole Life Policy?

A whole life insurance policy is a great option for individuals who want to provide their loved ones with financial stability and protection after they pass away. It’s also an excellent option for those who want to build wealth and save for future goals simultaneously. This type of policy is generally recommended for people who have long-term financial goals, as the policy builds cash value over time that can be used for various purposes.

Additionally, whole life insurance policies are often preferred by individuals who want a fixed premium that won’t increase over the life of the policy, providing peace of mind and predictable payments. Overall, a whole life insurance policy is a smart investment for anyone looking for a comprehensive and reliable way to protect their family and secure their financial future.

Individuals with Dependents

If you have people who depend on you financially, such as children, a spouse, or elderly parents, a whole life insurance policy is an excellent option for ensuring that they will be taken care of after you pass away. With a whole life policy, your beneficiaries will receive a tax-free death benefit that will help cover funeral expenses, outstanding debts, and provide ongoing financial support. It’s a reliable way to ensure that your loved ones will be able to maintain their lifestyle and needs even after you’re gone.

Those Looking to Maximize Their Savings

Not only does a whole life insurance policy provide death benefit protection, but it also allows you to accumulate cash value over time. The premiums you pay into the policy will earn interest and grow tax-free, providing you with a savings vehicle that can be used for a variety of purposes, including retirement, education, and emergencies.The accumulation of cash value can also serve as a source of collateral for loans, providing you with added financial flexibility.

Individuals Wanting Fixed Premiums

One of the most significant benefits of a whole life insurance policy is the fixed premium feature.With a fixed premium, you’ll have the comfort of knowing that your payments will stay the same over the life of the policy, providing you with predictable payments and avoiding any unexpected premium increases that could strain your budget. This makes it easier to plan and budget for the future, providing you with financial stability and peace of mind.

People Interested in Estate Planning

Whole life insurance can also be a valuable tool for estate planning.Since the policy provides a death benefit that is paid out tax-free, it can be used to help pay for estate taxes, ensuring that your heirs don’t have to sell assets to cover these costs. Additionally, a whole life policy can be used to transfer wealth to future generations, providing loved ones with a financial legacy and lasting support.

People with Estate Planning Needs

A whole life insurance policy can be beneficial for individuals who have specific estate planning needs. This type of policy provides a guaranteed payout to beneficiaries, which can help cover any debts or expenses that may arise after the policyholder’s passing. Whole life insurance can also assist in wealth transfer strategies by providing a tax-free inheritance to heirs.

By working with a financial advisor, individuals can incorporate a whole life policy into their estate plan and ensure that their wishes are carried out in the future.

Those Seeking Financial Stability

Whole life insurance can also provide long-term financial stability for policyholders and their families. Unlike term life insurance, which only covers a set period of time, whole life insurance policies offer permanent coverage. This means that as long as the policy premiums are paid, the policy will remain in effect and a payout will be guaranteed upon the policyholder’s death.

Furthermore, whole life insurance policies build cash value over time that can be used for various purposes, including supplementing retirement income or paying for unexpected expenses.

Overall, a whole life insurance policy can provide peace of mind and financial security for individuals and their loved ones.

Comparing Whole Life Insurance Policy With Other Types of Life Insurance

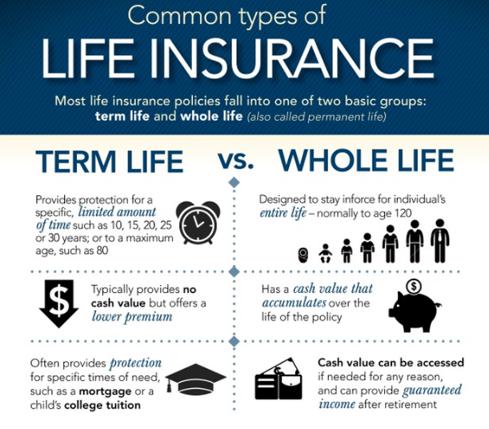

For those seeking a life insurance policy, it is important to understand the different types available and how they compare. Whole life insurance is a popular option because of its guaranteed coverage and cash value accumulation. Term life insurance, on the other hand, only provides coverage for a set period of time and does not build cash value.

Universal life insurance is another option that offers more flexibility with premiums and coverage amounts, but may also have higher fees and variable interest rates. Ultimately, the best choice depends on individual needs and financial goals.

When deciding on a life insurance policy, it is important to consult with a financial advisor and carefully consider all options to ensure long-term financial stability and security for yourself and your loved ones.

Whole Life Policy Vs Term Policy

When comparing whole life insurance with term life insurance, it is important to consider the level of coverage and investment benefits. Whole life insurance provides guaranteed coverage for the duration of one’s life, while term life insurance only covers a set period of time. Additionally, whole life insurance accumulates cash value over time, whereas term life insurance does not.

However, term life insurance policies tend to be more affordable and provide coverage during the most financially vulnerable years. Ultimately, the decision between whole life and term life insurance will depend on individual circumstances and financial goals.

Whole Life Policy Vs Universal Policy

Whole life insurance and universal life insurance are both types of permanent life insurance policies, but they differ in their flexibility and investment options. Whole life insurance offers a guaranteed death benefit and a fixed premium, while universal life insurance provides more flexibility with premium payments and potential investment returns.

With whole life insurance, the cash value accumulation is predictable and consistent, while universal life insurance allows for investment choices and more control over the cash value.

However, universal life insurance carries a greater risk and may require more active management from the policyholder.

Ultimately, the decision between whole life and universal life insurance will depend on individual preferences, financial goals, and the level of risk one is willing to take on.

Whole Life Policy Vs Variable Life Policy

Another type of permanent life insurance policy is variable life insurance, which differs from whole life insurance in its investment component. With variable life insurance, the policyholder can choose to invest their premiums in a variety of investment options, such as mutual funds. This provides the potential for higher cash value growth and greater flexibility in investment choices.

However, this also means that variable life insurance carries a higher risk, as the policyholder’s investment returns are not guaranteed. In contrast, whole life insurance offers a consistent and predictable cash value accumulation.

Ultimately, both whole life and variable life insurance policies offer their own unique benefits and drawbacks, and it’s important to carefully consider individual financial goals and risk tolerance when choosing a policy.

How to Choose a Whole Life Policy

When it comes to choosing a whole life insurance policy, there are several factors to consider. First and foremost, it’s important to determine how much coverage is needed to adequately protect loved ones in the event of the policyholder’s death.

Next, look at the premiums and payment schedule. Whole life insurance typically has higher premiums than term life insurance, so it’s important to make sure the premium payments fit within the budget.

Other considerations include the policy’s cash value accumulation and potential dividends, the insurance company’s financial stability and reputation, and any additional riders or benefits that may be included in the policy.

Working with a reputable and experienced insurance agent can also be beneficial in making an informed decision about which whole life policy is best suited to individual needs and circumstances.

Ultimately, a carefully chosen whole life insurance policy can provide lifelong protection and peace of mind for both the policyholder and their loved ones.

Assessing Financial Needs

To choose the right whole life policy, it’s important to assess one’s financial needs. This includes considering current and future expenses, such as mortgages, education expenses, and funeral costs. The goal is to ensure that the policy’s death benefit provides adequate coverage to meet these expenses and to provide financial security for loved ones.

A financial advisor or insurance agent can help in determining the appropriate coverage amount based on individual circumstances. Once the coverage amount is determined, it’s important to review the premium payments to ensure they fit within the budget.

Balancing coverage with affordability is key to choosing the right whole life policy.

Investment Goals

Whole life policies offer not only life insurance coverage but also investment opportunities. The policy’s cash value grows over time, providing a savings component that can be used to supplement retirement income, fund college expenses, or contribute to a legacy for heirs.

When considering a whole life policy, it’s important to assess one’s investment goals and risk tolerance.

Different policies offer varying returns and allocation options, such as equity investments or fixed-interest allocations. A financial advisor can assist in selecting a policy that aligns with the policyholder’s investment goals and risk tolerance.

It’s important to note that while whole life policies offer investment opportunities, they should not be used as the sole investment vehicle for long-term financial growth. Diversification is key to achieving long-term financial stability.

Insurance Company’s Credibility

When choosing a whole life policy, it’s important to consider the credibility of the insurance company. Look for a company with a strong financial rating, as this indicates its ability to fulfill its financial obligations, such as paying out death benefits.

Research the company’s history, customer reviews, and customer service reputation.

It’s also important to review the policy’s terms and conditions, including premiums, coverage, and the policyholder’s responsibilities.

Choosing a reputable insurance company can provide peace of mind and assurance that the policyholder’s investment in their future and their beneficiaries’ future is secure.

Ultimately, a whole life policy can offer a unique combination of life insurance and investment opportunities. By assessing investment goals, risk tolerance, and selecting a credible insurance company, policyholders can maximize the benefits of their policy for a secure financial future.

Common Misconceptions About Whole Life Policy

Many people have misconceptions about whole life insurance policies, which can make it difficult to understand if this type of policy is right for them. One common misconception is that whole life insurance is expensive, but in reality, the premiums can be affordable and provide long-term financial security. Another misconception is that whole life insurance is only for older individuals, while in reality, it can be beneficial to purchase at any age to start building financial security early.

It is essential to do your research and seek guidance from a financial advisor to determine if a whole life policy is the right fit for you.

Whole Life Policy is too Expensive

One of the biggest misconceptions about whole life policy is that it is expensive. While it is true that the premiums may be more costly than term life insurance, the long-term benefits and financial security it provides make it worth the investment.

Additionally, there are various payment options available, such as choosing a longer payment period or selecting a lower face amount to lower premiums. It is important to consider your unique financial situation and consult with a financial advisor before deciding on a policy that fits your budget and needs.

Whole Life Policy is Only for Older Individuals

Another common misconception is that whole life insurance is only for those who are older and closer to retirement age.However, this is not the case, and purchasing a whole life policy at a younger age can be incredibly beneficial for building long-term financial security. By starting early, you can accumulate cash value over time, which can be used for various purposes such as paying for your child’s education or as an additional retirement fund.

It is important to consider your financial goals and future plans before purchasing a policy and to seek guidance from a financial advisor to ensure that it aligns with your overall financial strategy. In conclusion, whole life insurance policies are easy to misunderstand due to common misconceptions. However, by doing your research and seeking guidance from a financial advisor, you can make an informed decision about whether a whole life policy is right for you.

Don’t let misconceptions hold you back from securing your financial future with a policy that fits your needs and budget.

Whole Life Policy Return on Investment is Low

Another common myth about whole life policy is that the return on investment is low compared to other investment options. However, it is important to note that whole life insurance should not be viewed solely as an investment but as a long-term financial tool that provides both protection and cash value accumulation.

Whole life policies have guaranteed cash value growth and compounded interest, which can accumulate over time and provide a stable source of savings. Additionally, the death benefit can be passed on to your beneficiaries tax-free.

While the return on investment may not be as high as some investment options, the stability and peace of mind that come with a reliable financial plan outweighs the potential risk of higher returns through riskier investments.

It is important to consider your overall financial goals and risk tolerance to determine if a whole life policy is a suitable option for you.

There are too many Hidden Fees

One of the biggest concerns for people considering a whole life policy is the fear of hidden fees. However, this is rarely the case.

Whole life policies have transparent and straightforward fee structures, which include the cost of insurance, administrative expenses, and agent commissions.

These fees are typically built into the policy and clearly outlined in the contract, so there should be no surprises.

It is essential to read and understand the policy before signing, which will give you a clear idea of the expenses and fees involved.

Additionally, your insurance agent can provide you with a detailed breakdown of the costs associated with the policy.

Overall, while there are fees associated with whole life policies, they are typically comparable to other types of insurance policies and are necessary to maintain the financial stability and longevity of the policy.

Important Factors to Consider Before Purchasing a Whole Life Policy

If you’re considering purchasing a whole life insurance policy, there are several factors to consider before committing to the investment. First and foremost, it’s essential to understand your financial needs and goals to determine if a whole life policy aligns with your long-term plans.

Additionally, consider the policy’s coverage amount and how it may affect your family’s financial security.

Furthermore, be mindful of the policy’s premiums and payment structure, as whole life policies typically require higher premiums than other types of insurance policies.

Finally, research the insurance company’s reputation, financial stability, and customer service ratings to ensure you’re working with a reliable and trustworthy provider.

By taking these factors into account, you’ll be better equipped to determine if a whole life policy is the right fit for your financial needs and goals.

Tax Implications

When purchasing a whole life policy, it’s also important to consider the tax implications. Unlike term life insurance policies, which typically don’t have any tax implications, whole life policies accumulate cash value over time, which can grow tax-deferred. However, if you access the cash value before death, you may be subject to income taxes and potential penalties.

It’s best to consult with a financial professional to understand the tax implications of a whole life policy before making a purchase. Additionally, if you’re using a whole life policy as an estate planning tool, it’s crucial to consider potential estate tax implications as well.

Living Benefits

When it comes to whole life insurance policies, tax implications are a vital consideration. Whole life policies accumulate cash value that can grow tax-deferred, which is an important advantage over term life policies.

However, withdrawing cash from the policy before death could result in income taxes and potential penalties. To make the best decision, consulting a financial expert is highly recommended before purchasing a policy, especially if you plan to use it as an estate planning tool. Additionally, whole life policies offer living benefits, which include cash value growth, lifetime coverage, and guaranteed death benefits.

These benefits make whole life policies an attractive option for those looking for both financial security and protection for their loved ones.

Inflation Protection

Whole life insurance policies provide not only lifelong coverage but also inflation protection. With inflation, the value of money decreases over time, which could affect the amount of coverage needed for your loved one’s financial security.

Nevertheless, whole life insurance policies guarantee a set death benefit amount, regardless of inflation’s effects. This assurance may ease any anxiety about the value of the policy decreasing due to inflation. Furthermore, the cash value that accumulates in the whole life insurance policy can offset any effects of inflation by serving as a hedge against it.

Thus, whole life insurance policies offer a promising way to combat inflation while ensuring your loved one’s financial security.

Conclusion of Life Insurance Whole Life Policy

In this web article, we discuss the benefits and drawbacks of whole life insurance policies. Whole life policies provide coverage for the entirety of a person’s life and can be a good option for those who want to leave a legacy or have a guaranteed payout.

However, they come with higher premiums and may not be the most cost-effective option for everyone. Ultimately, it’s important to carefully consider your individual needs and financial situation before choosing a life insurance policy.

FAQ’s of Life Insurance Whole Life Policy

How many years do you pay on a whole life policy?

The premium payments on a Whole Life policy are typically paid throughout the life of the insured, or until the policy matures.

How does a whole life policy work?

A whole life insurance policy provides lifelong coverage and builds up cash value over time. Premiums are higher than term life insurance, but they remain the same throughout the policy’s lifespan. The cash value can be accessed through withdrawals or policy loans, or it can be used to pay premiums or as collateral for a loan. Upon the insured’s death, the death benefit is paid out to the policy’s beneficiaries.

How does a whole life policy pay?

A whole life policy pays out by providing a guaranteed death benefit to the policyholder’s beneficiaries upon their death, as well as potential cash value accumulation over time. The policyholder pays premiums into the policy, which go towards this death benefit and the cash value component.

What is the disadvantage of whole life insurance?

The disadvantage of whole life insurance is that it is typically more expensive than term life insurance and may offer a lower rate of return on investment. Additionally, the policy may accumulate cash value over time, but accessing that cash value can come with high fees and penalties.

What are 2 disadvantages of whole life insurance?

Two disadvantages of whole life insurance are: 1. High premiums: Whole life insurance policies come with high premiums compared to other types of life insurance policies. This is because whole life insurance provides long-term coverage and has a cash value component that increases over time. 2. Limited investment options: Whole life insurance policies typically offer limited investment options with lower returns compared to other types of investments. The cash value component of the policy may also be subject to fees and surrender charges if withdrawn early, which can reduce the overall return on investment.

What is the benefit of a whole life insurance policy?

A whole life insurance policy provides lifelong coverage, a guaranteed death benefit, and the potential to build cash value over time, which can be borrowed against or used as a source of income in retirement.

What is a whole of life insurance policy?

A whole of life insurance policy is a type of life insurance policy that provides coverage for the entire lifetime of the policyholder. It pays out a lump sum to the beneficiaries upon the death of the policyholder, regardless of when that occurs. Whole of life insurance policies usually have higher premiums than term life insurance policies because the coverage is guaranteed for the policyholder’s lifetime.